04.05.2020 by Quentin DconledgerThere is not any upper limit to the variety of accounts concerned in a transaction - however the minimum is no less than two accounts. Thus, using debits and credits in a two-column transaction recording format is essentially the most essential... Read more

04.05.2020 by Quentin DconWhat are Unsecured Bonds?What is the difference between a bond and a note payable?Bonds payable that mature (or come due) within one year of the balance sheet date will be reported as a current liability if the issuer of the bonds must use a current... Read more

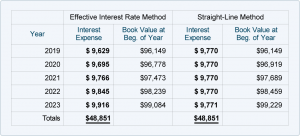

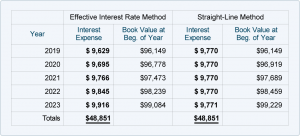

30.04.2020 by Quentin DconUnamortized Bond Discount DefinitionA lower interest rate means the corporate pays much less money in interest expense, which results in an increased web earnings and money flow. The company might have opted to not set up a sinking fund, however it w... Read more

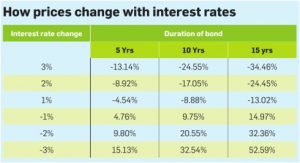

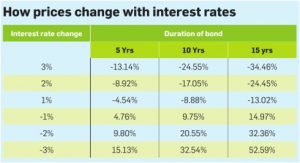

30.04.2020 by Quentin DconWhat’s the Difference Between Premium Bonds and Discount Bonds?Also, as charges rise, traders demand a better yield from the bonds they think about buying. If they anticipate charges to proceed to rise in the future they don't desire a fixed-ra... Read more

30.04.2020 by Quentin DconBond DefinitionThe enterprise will then must report a “bond premium” for the difference between the amount of cash the enterprise received and the bonds’ face value. An group may incur numerous costs when it issues debt to traders.... Read more

30.04.2020 by Quentin DconThe Benefits to Investing in BondsA key threat of proudly owning mounted price bonds is interest rate threat or the chance that bond rates of interest will rise, making an investor’s current bonds less priceless. For example, let’s assume... Read more

30.04.2020 by Quentin DconExplaining Amortization within the Balance SheetBut in the future, if rates go up, then the curiosity expense mechanically rises to regulate to the altering situations. It's due to this fact inconceivable to know upfront what the whole expense might... Read more

29.04.2020 by Quentin DconSupplemental IndentureCallable or redeemable bonds are bonds that can be redeemed or paid off by the issuer prior to the bonds' maturity date. When an issuer calls its bonds, it pays buyers the decision worth (usually the face value of the bonds) alo... Read more

29.04.2020 by Quentin DconIs the Bond Market Still a Good Investment in 2019? What to Know and What to Do About ItThe bond market is efficient and matches the present worth of the bond to mirror whether present interest rates are greater or decrease than the bond's coupon rat... Read more

29.04.2020 by Quentin DconIonic bond dictionary definitionWhat are stocks and bonds?A chemical bond is an enduring attraction between atoms, ions or molecules that enables the formation of chemical compounds. The bond may result from the electrostatic pressure of attraction b... Read more