01.11.2021 by Quentin DconDepending on filing requirements, you’ll need to pay the government all the taxes withheld during a given period of time (e.g., every three months, every 12 months). So if the employee in the example above worked 45 weeksduring the year and had... Read more

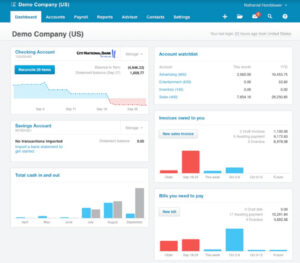

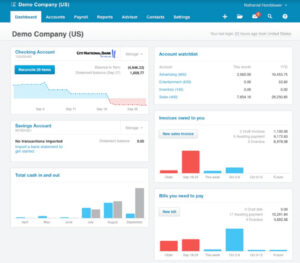

29.10.2021 by Quentin DconIt has an attractive, intuitive interface and dashboard that shows several graphs to give you an overview of your sales over time, income, expenses, and profit and loss. You can click on the images to drill down into each set of information.Finally,... Read more

29.10.2021 by Quentin DconA business records the cost of intangible assets in the assets section of the balance sheet only when it purchases it from another party and the assets has a finite life. Let's say a company spends $50,000 to obtain a license, and the license in ques... Read more

28.10.2021 by Quentin DconWe ended up finding a local CPA who we’ve been with ever since - no yearly fee, no monthly fee, no hourly fee. He charges a flat fee for tax prep and no fee for any questions that may arise. They got the tax prep for FREE for the services of LL... Read more

27.10.2021 by Quentin DconThis may require an adjusting entry to reclass rent expense to a prepaid account. Going forward, a monthly entry will be booked to reduce the prepaid expense account and record rent expense. A prepaid is when you pay for a good or service in a... Read more

29.05.2021 by Quentin DconOverviewAny enterprise has assets on its Balance sheet that are used for production and administrative purposes. During operation, these undergo natural wear and tear: furniture, appliances, industrial, commercial, office equipment, vehicles, and oth... Read more

28.05.2021 by Quentin DconOverviewIndividuals work hard to earn their money. A paycheck is a long-awaited reward for all that hard work. Many individuals are forced to live on a paycheck to paycheck basis, so it is no wonder that most employees expect employers to pay their w... Read more

27.05.2021 by Quentin DconDefinition

Petty cash is used in companies for small dollar item purchases that need to be paid in cash. Usually, petty cash is used for purchases such as coffee, water, and donuts for meetings, postage, office supplies, or other miscellaneous expen... Read more

26.05.2021 by Quentin DconOverviewLet's face it, accounting is never the most exciting part of running a business unless you're a trained accountant or enjoy playing with numbers. From keeping track of revenue sales and spendings to calculating taxes and employee payroll, the... Read more

25.05.2021 by Quentin DconOverviewHappy employees are key for business growth and development. It is essential that your workforce is paid accurately and on time. Payroll is not just exclusively paying employees on a month-to-month basis (or however often your business does i... Read more