22.11.2021 by Quentin DconThe IRS allows businesses to take several accelerated depreciation deductions for tangible business assets and some improvements. These special options aren't available for the amortization of intangibles. Negative amortization is actually a feature... Read more

19.11.2021 by Quentin DconAn investor who buys a stock on 50% margin will lose 40% if the stock declines 20%.; also in this case the involved subject might be unable to refund the incurred significant total loss. In this ratio, operating leases are capitalized and equity incl... Read more

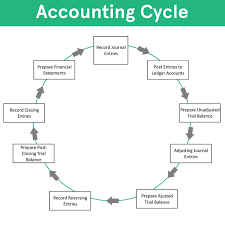

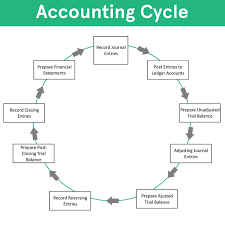

18.11.2021 by Quentin DconDeferrals, on the other hand, are often related to an expense that is paid in one period but is not recorded until a different period. Both accrual and deferral entries are very important for a company to give a true financial position. Moreover, bot... Read more

18.11.2021 by Quentin DconIf your business makes money from rental property, there are a few factors you need to take into account before depreciating its value. If you want to record the first year of depreciation on the bouncy castle using the straight-line depreciation met... Read more

16.11.2021 by Quentin DconIf you know the total amount consumed and the total percentage of the paid tax amount, you can conclude the percentage tax rate. For example, in many states where farming is the primary industry, the total price of products or equipment used to produ... Read more

16.11.2021 by Quentin Dcon(If the asset is still working, the company can keep using it, but it's done recording the expense.) Amortizable assets get reduced to zero. Depreciable assets get reduced to "salvage value," which is what the company could expect to get for the asse... Read more

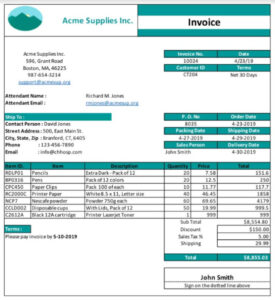

16.11.2021 by Quentin DconFor example, interest expense is part of other revenues and expenses, as are most gains or losses on early retirement of debt. An example of off-balance-sheet financing is an unconsolidated subsidiary. A parent company may not be required to consolid... Read more

15.11.2021 by Quentin DconA debit to a revenue account (111.11) is decreasing the revenue account's actual amount . Then, one day, the company accountant visited the office.The concept of debits and credits may seem foreign, but the average person uses the concept behind the... Read more

15.11.2021 by Quentin DconLearn more about what a balance sheet is, how it works, if you need one, and also see an example. A sample balance sheet for the fictitious Springfield Psychological Services at December 31, 2004 and 2003 is presented below, as an example.This incred... Read more

12.11.2021 by Quentin DconAs the name implies, a single-step income statement uses a single calculation to determine a company's net income. The income statement is one of three key financial statements used by all companies, from small businesses to large corporations. A bas... Read more