02.12.2021 by Quentin DconIt has debit and credit columns to record the balances extracted from ledger accounts with a view to test the arithmetical accuracy of the books of accounts. While the definition of the document is relatively straightforward, you’re probably th... Read more

30.11.2021 by Quentin DconBy placing both revenues and expenses in the same period, your business’s financial statements will contain measures of both your accomplishments and efforts. This transparency lets investors clearly assess your company’s performance.Debi... Read more

26.11.2021 by Quentin DconA comparison of present value with future value best illustrates the principle of the time value of money and the need for charging or paying additional risk-based interest rates. Simply put, the money today is worth more than the same money tomorrow... Read more

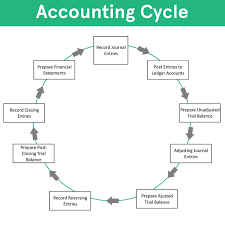

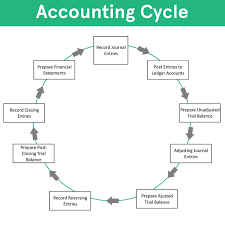

26.11.2021 by Quentin DconThe main objective of bookkeeping is to keep all financial transactions recorded properly and systematically. Accounting’s objective is to gauge a company’s financial situation and to communicate that information with the relevant people.... Read more

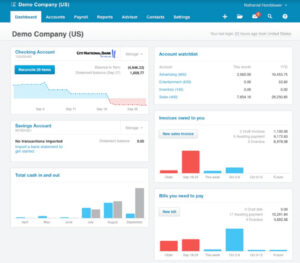

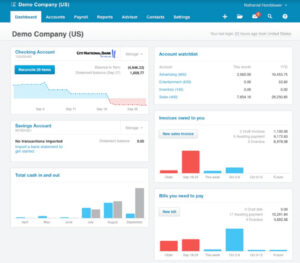

25.11.2021 by Quentin DconWe’ll do one month of your bookkeeping and prepare a set of financial statements for you to keep. Financial Intelligence takes you through all the financial statements and financial jargon giving you the confidence to understand what it all mea... Read more

24.11.2021 by Quentin DconSales ledger, which deals mostly with the accounts receivable account. This ledger consists of the records of the financial transactions made by customers to the business. A bookkeeper is responsible for identifying the accounts in which transactions... Read more

23.11.2021 by Quentin DconIncome statements include revenue, costs of goods sold, andoperating expenses, along with the resulting net income or loss for that period. The foundation of the balance sheet lies in the accounting equation where assets, on one side, equal equity pl... Read more

23.11.2021 by Quentin DconNext companies must account for interest income and interest expense. Interest income is the money companies make from keeping their cash in interest-bearing savings accounts, money market funds and the like. On the other hand, interest expense is th... Read more

22.11.2021 by Quentin DconThe companies can very well take tax reductions on depreciating items. Businesses calculate it meticulously as they remain the prime part of the industry functionality too. The value reduction of a particular asset is categorized into two types; Depr... Read more

22.11.2021 by Quentin DconUnderstand these critical pieces of notation by exploring the definitions and purposes of debits and credits and how they help form the basics of double-entry accounting. Accounting is a rule-based system that requires memorization of the debits and... Read more