Administrative Costs in Accounting: Definition & Examples

What Are Examples of Cost of Goods Sold (COGS) for Businesses That Sell Online?

Administrative expenses are prices associated to the final administration of the enterprise. This category of prices does not relate particularly to any business perform corresponding to production and gross sales.

Instead these bills are reported on the earnings assertion of the period by which they happen. Selling and administrative expenses are sometimes a huge line merchandise on a company’s earnings assertion. It includes most every expense the corporate incurs not directly related to the manufacturing of its merchandise. Whether an organization wants to grow, reduce costs, or just preserve what it is doing, managers must pay close attention to this figure and all its part components. Managing this part of the income statement is a crucial element to running a profitable enterprise.

G&A expenses embrace rent, utilities, insurance, authorized charges, and certain salaries. Selling expenses are those a business incurs to market and promote its services to clients.

Understanding Administrative Expenses

Insurance, depreciation, hire, and utilities may be categorized as manufacturing overhead, selling, or administrative expenses, depending on which enterprise function they relate to. In instances of monetary problem, working expenses can turn into an essential focus of management when implementing cost controls.

Although operating expenses include a wide range of costs, certain gadgets don’t belong in the section. Any costs directly associated to manufacturing inventory or the price to buy stock are part of the “value of goods offered” line on the earnings assertion, which is reported separately from working expenses.

In other words, administrative expenses are a subset of operating expenses and can be listed as G&A to separate selling bills from the overall administrative costs of operating the company. Of course, if an organization contains its selling costs in administrative bills, it’ll be listed under SG&A on the revenue statement. The determination to record SG&A and operating expenses individually on the earnings statement is as much as the corporate’s administration.

What Are the Types of Costs in Cost Accounting?

Some companies might favor more discretion when reporting worker salaries, pensions, insurance, and advertising prices. As a outcome, an aggregate whole of all non-production expenses is compiled and reported as a single line merchandise titled SG&A.

What Does General and Administrative Expenses Mean?

SG&A bills are sometimes the prices related to an organization’s total overhead since they can not be immediately traced to the production of a services or products. Interest expense is likely one of the notable bills not in SG&A and is listed as a separate line item on the income assertion. General and administrative (G&A) expenses are listed below cost of products bought (COGS) on a company’s earnings assertion. The prime part of an earnings assertion always displays the corporate’s revenues for the given accounting interval. The common and administrative bills are then deducted from the gross margin to arrive at net income.

How Do Operating Expenses Affect Profit?

- While this is typically synonymous with operating bills, many instances corporations list SG&A as a separate line item on the earnings statement below cost of products sold, underneath expenses.

- Selling, general, and administrative expenses additionally include a company’s operating expenses that are not included in the direct prices of production or price of goods sold.

- When a enterprise creates an revenue statement, it generally separates the revenue and expense gadgets into sections on what’s called a multi-step earnings statement.

However, some firms may report promoting bills as a separate line merchandise, in which case the SG&A is changed to G&A. Like operating expenses, administrative bills are incurred regardless of the number of sales being generated by the corporate. General prices such as office provides, phone bills, and postage are thought-about to be administrative expenses. Compensation for employees who provide total support for the company that isn’t tied to a specific department can also be thought of an administrative expense.

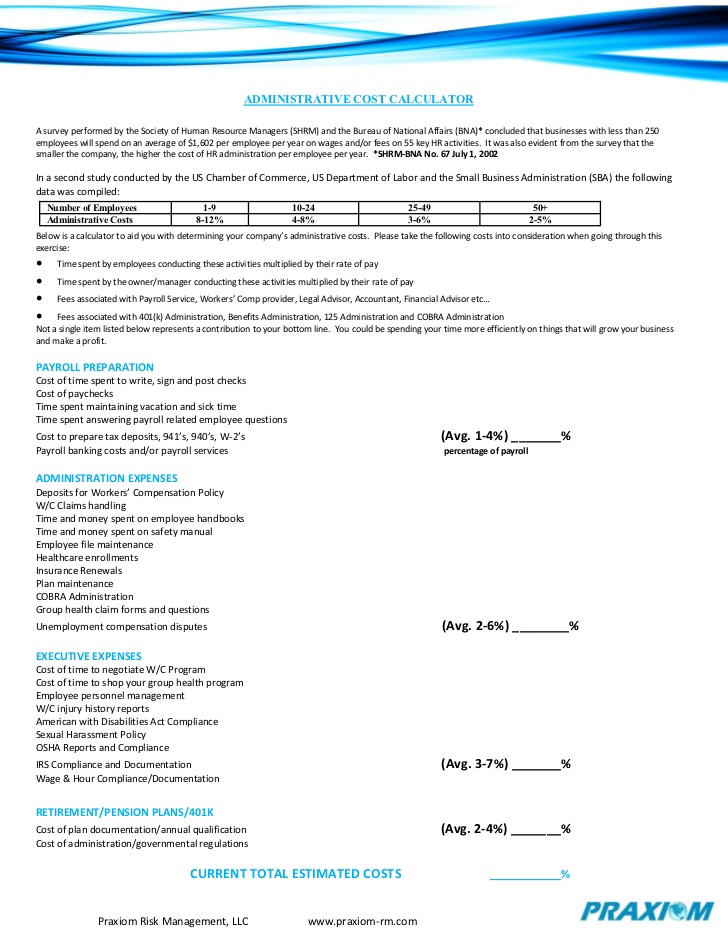

They are generally known as selling, basic and administrative bills or various combinations of the three. Administrative bills are costs related to the general administration of a business. These costs relate to the enterprise normally and don’t relate to any specific perform, like manufacturing and sales. By cost behavior, most of these costs are mounted, although there are variable or combined administrative bills. Administrative expenses are presented as a part of working expenses, that are deducted from gross revenue or gross income to reach at operating earnings before finance price and taxes.

Selling, general, and administrative expenses also consist of an organization’s working bills that are not included in the direct costs of production or price of products bought. While that is sometimes synonymous with operating expenses, many instances companies listing SG&A as a separate line merchandise on the earnings assertion under cost of goods sold, underneath expenses. When a business creates an revenue statement, it sometimes separates the income and expense gadgets into sections on what’s referred to as a multi-step revenue statement. This type of income assertion helps homeowners analyze totally different features of the corporate’s efficiency. These bills are the costs a small enterprise incurs in its main enterprise actions in the course of the accounting interval.

Administrative expenses are the bills a corporation incurs in a roundabout way tied to a particular perform similar to manufacturing, production, or sales. These expenses are related to the group as a whole versus a person division or enterprise unit. Salaries of senior executives and prices associated with basic providers corresponding to accounting and information technology (IT) are examples of administrative expenses.

What are examples of administrative expenses?

Administrative expenses are the expenses an organization incurs not directly tied to a specific function such as manufacturing, production, or sales. Salaries of senior executives and costs associated with general services such as accounting and information technology (IT) are examples of administrative expenses.

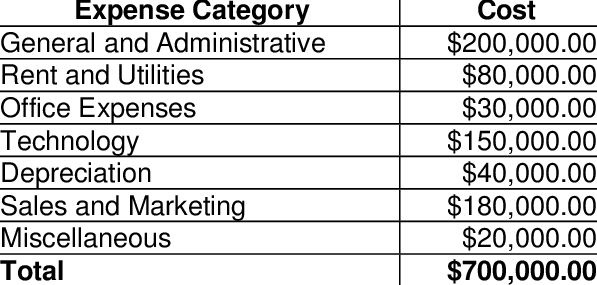

For example, charges and interest may be categorized as their own line merchandise when deducting bills to arrive at web income. General and administrative (G&A) expenses are incurred in the day-to-day operations of a business and is probably not immediately tied to a specific function or division within the company. General bills pertain to operational overhead expenses that influence the complete business. Administrative bills are expenses that can not be immediately tied to a selected function throughout the firm such as manufacturing, manufacturing, or sales.

Operating expenses embrace costs which might be incurred even when no gross sales are generated, similar to promoting prices, lease, curiosity funds on debt, and administrative salaries. But typically, selling, basic and administrative expenses represent the same costs as working expenses. Typically, the operating expenses and SG&A of a company characterize the identical costs – those independent of and never included in price of products bought. But sometimes, SG&A is listed as a subcategory of operating expenses on the earnings statement.

Such items embrace sales commissions, wages and salaries for sales staff, hire and utilities for a sales workplace, promoting prices and promotional materials. On the face of the income assertion, administrative bills are introduced as part of operating expenses, together with the corporate’s selling expenses. Operating bills are deducted from gross profit or gross earnings to arrive at operating revenue before finance price and taxes. However, if there are certain administrative expense objects that the company considers material, these could also be offered individually as other line items.

Also, revenue tax expenses, interest expenses and losses on the sale of belongings belong within the non-working expenses part. This separation helps a enterprise assess its core working prices from interval to interval with out the effects of financing or one-time charges. Examples of these costs are executive salaries and bonuses, salaries and wages of personnel performing staff functions, professional fees, office provides, and subscriptions.

Understanding General and Administrative Expenses (G&A)

Operating expenses and promoting, common and administrative expenses (SG&A) are both forms of costs concerned in operating a company, and significant in determining its monetary properly-being. While generally synonymous, they every can be listed separately on the company earnings assertion.