Tax provisions are an amount set aside specifically to pay a company’s income taxes.In order to calculate the tax amount owing, a business needs to adjust its gross income by the amount of tax deductions it is claiming. In financial accounting under International Financial Reporting Standards (IFRS), a provision is an account that records a present liability of an entity. The recording of the liability in the entity’s balance sheet is matched to an appropriate expense account on the entity’s income statement. In U.S. Generally Accepted Accounting Principles (U.S. GAAP), a provision is an expense. As a current liability on the liabilities side of the balance sheet, like provision for income tax, provision for repairs, etc. A provision in accounting refers to an amount that has been set aside from the profits of the business in order to meet an unanticipated loss.

Provisions can be found in the laws of a country, in loan documents, and in investment-grade bonds and stocks. For example, the anti-greenmail provision contained within some companies’ charters protects shareholders from the board passing stock buybacks. Although most shareholders favor stock buybacks, some buybacks allow board members to sell their stock to the company at inflated premiums.

IFRS Accounting

Built for freelancers, sole traders, and small businesses, Debitoor grows with your company. A provision is not a form of savings; instead, it is a recognition of an upcoming liability. Stay on top of your company finances with Debitoor invoicing software, designed for sole traders, freelancers, and small businesses. Designed for freelancers and small business owners, Debitoor invoicing software makes it quick and easy to issue professional invoices and manage your business finances.

In accounting, the matching principle states that expenses should be reported in the same financial year as the correlating revenues. This is because costs that belong to a certain year can become misleading if accounted for in previous or future financial years. An example of a provision could be a car company setting aside money for warranty repairs for the last quarter of the year. The provisional amount will be estimated based on past warranty expenses, related to car sales. In the International Financial Reporting Standards (IFRS), the treatment of provisions (as well as contingent assets and liabilities) is found in IAS 37. Provisions are not recognized for operational costs, which are expenses that need to be incurred by an entity to operate in the future.

Companies elect to make them for future obligations whose specific amount or date of incurrence is unknown. The provisions basically act like a hedge against possible losses that would impact business operations. This provision is usually included in the budget created by a company and can be estimated based on past experience with bad debt amounts as well as industry averages. Provisions therefore adjust the current year balance to be more accurate by ensuring that costs are recognised in the same accounting period as the relevant expenses. Contingent liabilities are possible obligations whose existence will be confirmed by uncertain future events that are not wholly within the control of the entity.

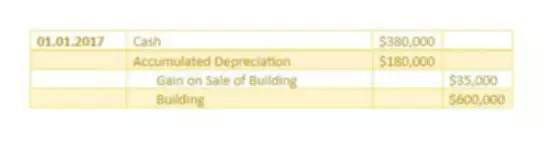

How to Record Provisions

It’s very difficult to draw clear lines between accrued liabilities, provisions, and contingent liabilities. In many respects, the characterization of an expense obligation as either accrual or provision can depend on the company’s interpretations. The IFRS sometimes calls a provision a reserve; however, reserves and provisions are not interchangable concepts. Whereas a provision is intended to cover upcoming liabilities, a reserve is part a business’s profit, set aside to improve the company’s financial position through growth or expansion.

- In April 2001 the International Accounting Standards Board adopted IAS 37 Provisions, Contingent Liabilities and Contingent Assets, which had originally been issued by the International Accounting Standards Committee in September 1998.

- In May 2020 the Board issued Onerous Contracts—Cost of Fulfilling a Contract.

- An example of a provision is a product warranty or an income tax liability.

- Please note that some information might still be retained by your browser as it’s required for the site to function.

- As a current liability on the liabilities side of the balance sheet, like provision for income tax, provision for repairs, etc.

Most importantly, the event must be near-certain, or at least highly probable. It can be estimated well ahead of time, and money can be set aside for it in a very specific fashion. The accrued expense is listed in the ledger until payment is actually distributed to the shareholders.

Related IFRS Standards

While making cash flows, provisions should not be taken as there is no cash outflow/inflow. In financial reporting, provisions are recorded as a current liability on the balance sheet and then matched to the appropriate expense account on the income statement. Loan loss provisions serve as a standardized accounting adjustment made to a bank’s loan loss reserves appearing in the lender’s financial statements. They incorporate any change in potential loss projections from the bank’s lending products due to client defaults.

IAS 27 — Non-cash distributions

The key principle established by the Standard is that a provision should be recognised only when there is a liability i.e. a present obligation resulting from past events. The Standard thus aims to ensure that only genuine obligations are dealt with in the financial statements – planned future expenditure, even where authorised by the board of directors or equivalent governing body, is excluded from recognition. Provisions in Accounting are an amount set aside to cover a probable future expense, or reduction in the value of an asset. Examples of provisions include accruals, asset impairments, bad debts, depreciation, doubtful debts, guarantees (product warranties), income taxes, inventory obsolescence, pension, restructuring liabilities and sales allowances. The recording of provisions occurs when a company files an expense in the income statement and, consequently, records a liability on the balance sheet. Typically, provisions are recorded as bad debt, sales allowances, or inventory obsolescence.

Translations of the updated educational material on applying IFRSs to climate-related matters

Provisions for banks work a little differently than they do for corporations. Banks make loans to borrowers, which come with a risk that the loan will not be paid back. Loan loss provisions work similarly to the provisions that corporations make, in that banks set aside a loan loss provision as an expense. Loan loss provisions cover loans that have not been paid back or when monthly loan payments have not been met. Contingent assets are possible assets whose existence will be confirmed by the occurrence or non-occurrence of uncertain future events that are not wholly within the control of the entity.