Accruals concept — AccountingTools

The sale is booked to an account generally known as accounts receivable, discovered within the present assets part of the balance sheet. Accrued expenses (additionally called accrued liabilities) are payments that an organization is obligated to pay sooner or later for which items and providers have already been delivered. These forms of bills are realized on the steadiness sheet and are often current liabilities. Accrued liabilities are adjusted and recognized on the stability sheet on the finish of every accounting period; changes are used to document items and services which have been delivered but not yet billed. When the corporate’s accounting division receives the bill for the whole quantity of salaries due, the accounts payable account is credited.

Accrual accounting, subsequently, provides the corporate a means of tracking its monetary position extra precisely. The money methodology is the simplest in that the books are kept primarily based on the precise circulate of cash out and in of the business.

Accrued bills are realized on the stability sheet at the finish of an organization’s accounting period when they are recognized by adjusting journal entries within the firm’s ledger. With the accrual methodology, you record expenses as they are incurred, not whenever you exchange money. The cash-basis method of accounting doesn’t acknowledge accrued liabilities. Prepayments are mostly prepaid expenses in the corporate environment.

Accrued bills vs. accounts payable

The net outcome in the following month is due to this fact no new expense recognition at all, with the legal responsibility for cost shifting to the accounts payable account. Current assets are objects of worth the company owns that might be easily converted to cash.

They are thought of to be present liabilities as a result of the payment is often due within one 12 months of the date of the transaction. Accounts payable are acknowledged on the balance sheet when the company buys goods or services on credit score.

Thus, the current asset balance isn’t affected on fee; it is only affected when the money is used. Both accrued bills and accounts payable are accounted for under “Current Liabilities” on a company’s stability sheet. Because the corporate really incurred 12 months’ worth of salary bills, an adjusting journal entry is recorded on the finish of the accounting interval for the final month’s expense. The adjusting entry might be dated December 31 and may have a debit to the salary expenses account on the income assertion and a credit score to the salaries payable account on the steadiness sheet.

Accrued Expense vs. Accrued Interest: What’s the Difference?

Accounts payable, then again, are current liabilities that shall be paid in the close to future. Below, we go right into a bit extra element describing each kind of stability sheet item. The accrual method recognizes income when the services offered for the shopper are concluded although money is not yet within the bank.

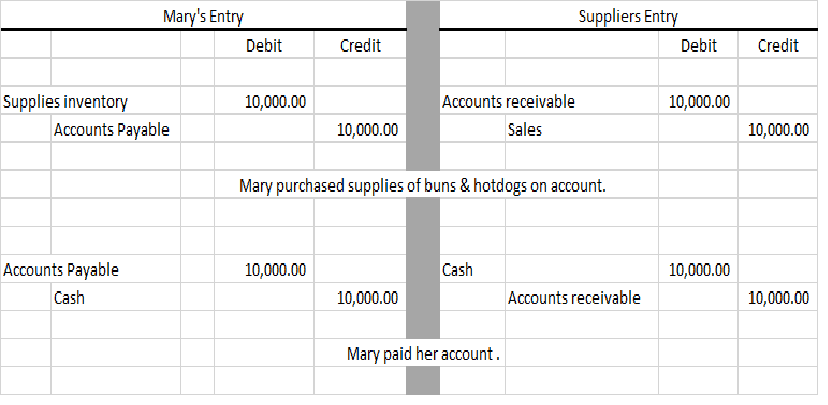

The accrued expense might be recorded as an account payable underneath the present liabilities part of the stability sheet, and in addition as an expense within the earnings statement. On the final ledger, when the bill is paid, the accounts payable account is debited and the money account is credited. Accrued expenses are expenses a company accounts for after they happen, versus when they’re really invoiced or paid for. An accrual methodology permits a company’s financial statements, such as the steadiness sheet and revenue statement, to be more accurate. Accounts payable (AP), typically referred merely to as “payables,” are a company’s ongoing bills which are usually short-time period money owed which must be paid off in a specified period to avoid default.

- Under the accrual method of accounting, the corporate receiving items or providers on credit must report the liability no later than the date they were acquired.

- The accrued expense shall be recorded as an account payable under the present liabilities part of the steadiness sheet, and also as an expense in the revenue statement.

- A company that incurs an expense that it is yet to pay for will recognize the business expense on the day the expense arises.

Companies must account for expenses they have incurred up to now, or which will come due sooner or later. Accrual accounting is a technique of monitoring such accrued funds, both as accrued bills or accounts payable. Accrued expenses are those liabilities which have constructed up over time and are due to be paid.

This idea differs from the money foundation of accounting, underneath which revenues are recorded when cash is obtained, and expenses are recorded when cash is paid. Similarly, an accrual foundation firm will record an expense as incurred, while a cash foundation firm would as an alternative wait to pay its supplier earlier than recording the expense. Thus, if the amount of the office supplies had been $500, the journal entry could be a debit of $500 to the office provides expense account and a credit score of $500 to the accrued bills liability account. However, the recording of transactions in money accounting occurs at the time of money transactions. The electrical energy company wants to attend till the top of the month to receive its revenues, despite the during-the-month expenses that it has.

How do accrued liabilities work?

This method requires you to make two opposite but equal entries for every transaction. A enterprise that uses the accrual basis of accounting recognizes income and bills in the accounting period during which they are earned or incurred, no matter when payment occurs. This differs from the money basis of accounting, under which a business recognizes revenue and expenses solely when cash is acquired or paid. Two ideas, or rules, that the accrual basis of accounting uses are the income recognition precept and the matching precept. Accrual basis accounting is the usual strategy to recording transactions for all larger companies.

A company that incurs an expense that it is yet to pay for will recognize the enterprise expense on the day the expense arises. Under the accrual methodology of accounting, the corporate receiving goods or services on credit must report the liability no later than the date they were acquired.

If the corporate is owed bond curiosity and uses accrual accounting to acknowledge revenue on the time it’s earned, it might debit interest receivable and credit accrued revenue. Once the amount is collected, it turns into a part of the money balance, which is also a present asset.

These expenditures are paid in full in one accounting interval for an underlying asset to be consumed in a future interval. The prepayment is reclassified as a traditional expense when the asset is actually used or consumed. A prepaid expense is first categorized as a present asset on the corporate’s steadiness sheet. To proceed with the preceding instance, the $500 entry would reverse in the following month, with a credit score to the workplace supplies expense account and a debit to the accrued bills legal responsibility account.

What kind of account is accrued expenses?

Usually, an accrued expense journal entry is a debit to an expense account. The debit entry increases your expenses. You also apply a credit to an accrued liabilities account. And, your liabilities increase on the balance sheet.

Examples of accrued liabilities

Accounts payable is discovered in the current liabilities part of the balance sheet and represents the quick-term liabilities of a company. After the debt has been paid off, the accounts payable account is debited and the cash account is credited. Accounts payable is the entire amount of quick-time period obligations or debt a company has to pay to its collectors for items or companies bought on credit score. On the opposite hand, accrued expenses are the whole legal responsibility that’s payable for goods and providers that have been consumed by the corporate or obtained but haven’t but been billed.

Income is recorded when it is received, and bills are reported when they’re really paid. The cash method is utilized by many sole proprietors and businesses with no inventory. From a tax standpoint, it is typically advantageous for a new business to make use of the money technique of accounting. That way, recording revenue can be delay till the next tax 12 months, whereas bills are counted instantly.

Prepaid bills are funds made upfront for goods and companies which are expected to be supplied or used in the future. While accrued expenses represent liabilities, pay as you go bills are recognized as assets on the stability sheet. AccountDebitCreditCash AccountXAccrued Liability AccountXWhen the original entry is reversed (displaying you paid the expense), it’s faraway from the balance sheet. To document accrued expenses, use debit and credit journal entries. In accrual accounting, you have to use a double-entry bookkeeping system.