An accrued expense is the expenses which is incurred by the company over one accounting period but not paid in the same accounting period. In the books of accounts it is recorded in a way that the expense account is debited and the accrued expense account is credited. Accrued ExpensesAn accrued accrual vs deferral expense is the expenses which is incurred by the company over one accounting period but not paid in the same accounting period. The key benefit of accruals and deferrals is that revenue and expense will align so businesses can account for all expenses and revenue during an accounting period.

For example, water expense that is due in December, but the payment of that expense will be not be made until January. Similarly, accrual of revenue refers to the reporting of that receipt and the related receivable in the period in which they are earned, and that period is prior to the cash receipt of that revenue. For example, interest earned on the investment of bonds in December, but the cash will not come until March of next year. Let’s say a customer makes an advance payment in January of $10,000 for products you’re manufacturing to be delivered in April. You would record it as a debit to cash of $10,000 and a deferred revenue credit of $10,000. An example of revenue accrual would occur when you sell a product for $10,000 in one accounting period but the invoice has not been paid by the end of the period. You would book the entry by debiting accounts receivable by $10,000 and crediting revenue by $10,000.

Manage Your Business

The remaining book value is equivalent to the salvage value established when the vehicle was purchased. Book value will be used to calculate any gain or loss when the truck is sold or traded. DateAccountDebitCreditJan-31Insurance Expense$100Prepaid Insurance$100To record one month insurance policyAnd finally, the Ledger accounts. Money has changed hands, but conditions are not yet satisfied to record a revenue or expense.

What are deferred contributions?

Deferred capital contributions are contributions received by an entity for the purchase of capital assets. The deferred capital contributions are brought into revenue over time to match the amortization expense (so the net impact on the bottom line is nil).

Knowing the difference between these two adjusting entries is integral for every accountant who wants to make sure that their books remain up to date and concrete in terms of the accounts they handle. Therefore, the next 5 months are deferred on the company’s financial statements as Prepaid Insurance until they can be moved to Insurance Expenses after the 5 months have elapsed. Therefore, in deferral accounting, the account is where the income is recognized at a future date. Allocating the income to sales revenue may not seem like a big deal for one subscription, but imagine doing it for a hundred subscriptions, or a thousand. The earnings would be overstated, and company management would not get an accurate picture of expenses vs revenue. In November, Anderson Autos pays the full amount for the upcoming year’s subscription, which is $602.

What Is The Difference Between An Accrual And A Deferral?

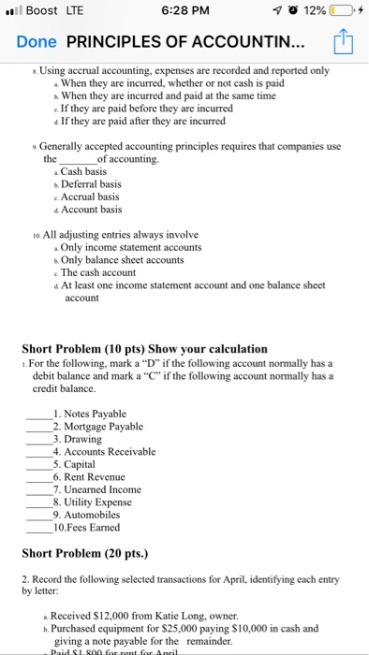

Deferring expenses helps businesses keep track of their expense cash flows and gives a more accurate picture of quarterly performance. Accrued expenses are noted at the time they occur, regardless of whether your business has paid them.

That is, rather than accruals providing enhanced earnings figures, they do the opposite. Below is an example of a journal entry for three months of rent, paid in advance. In this transaction, the Prepaid Rent is increasing, and Cash is decreasing. Debits and credits are used in a company’s bookkeeping in order for its books to balance.

Accrued interest refers to the interest that has been incurred on a loan or other financial obligation but has not yet been paid out. Accrued expenses are the expenses of a company that have been incurred but not yet paid. Must include the date the income was received, and date of the event in the Explanation field.

The remaining amount should be adjusted on a month on month basis and should be deducted from the Unearned Revenue monthly as the services will be rendered by the firm to their customers. Under the revenue recognition principles of accrual accounting, revenue can only be recorded as earned in a period when all goods and services have been performed or delivered. In the case of a prepayment, a company’s goods or services will be delivered or performed in a future period. The prepayment is recognized as a liability on the balance sheet in the form of deferred revenue. When the good or service is delivered or performed, the deferred revenue becomes earned revenue and moves from the balance sheet to the income statement. SaaS businesses sell pre-paid subscriptions with services that are rendered over time and hence require the use of the accrual basis of accounting. Revenue recognition in SaaS is done when the service is rendered and the revenue is ‘earned’.

- In some cases, customers may pay before the unit provides a good or service for them; however, revenue should only be recorded in period when it is earned.

- Also, the accrual basis of accounting is necessary for audit purposes as the books all over the world are prepared on an accrual basis.

- The second type is the revenue accrual which refers to the reporting of a transaction that occurred as revenue and the asset that it occurred against.

- For example, if $1,000 of supplies were purchased on February 1, the proper accounting entries are a $1,000 debit entry to the supplies account and a $1,000 credit entry to the cash account.

- When revenues are earned but not yet recorded at the end of the accounting period because an invoice has not yet been issued, nor has cash payment been received.

- In both of these cases, it’s not possible to match income and expenses when you use cash accounting.

- However, the client may pay you the entire amount for the service up front.

When you pay a company for a service, you will record a debit to a prepaid expense account and a credit to your cash account. Example Of Deferred RevenueDeferred revenue or unearned revenue is the number of advance payments that the company has received for the goods or services still pending for the delivery or provision. Its examples include an annual plan for the mobile connection, prepaid insurance policies.

How Accruals Affect Business

4Note that taxpayers can now use the cash method of accounting for federal income tax purposes if their average annual gross receipts for the prior three years do not exceed $25 million. Also, such taxpayers can treat inventory as nonincidental materials and supplies and avoid the rules of Secs. In some cases, customers may pay before the unit provides a good or service for them; however, revenue should only be recorded in period when it is earned. Deposits (whether refundable or non-refundable) and early or pre-payments should not be recognized as revenue until the revenue-producing event has occurred. Deferred revenues reflect situations in which money has been received, but goods and services haven’t been provided. These revenues are also known as deposits, and they are not recognized as revenues in the income statement. Deferred revenues are not “real revenues.” They don’t affect net income or loss at all.

Once earned, they will be moved from Unearned Revenues to Service Revenues. Let’s assume that an insurance company is on the receiving end of the customer and is being paid in advance for its insurance. It will provide the customer with insurance for the next 6 months, but these services are not yet completed. Another example of this could be that when a company purchases supplies, it defers the cost of those supplies since not all the supplies bought were used or consumed during the accounting period it was reported under. Therefore, an adjusting entry would be necessary to defer the cost of the supplies that the company did not utilize.

What Is The Point Of Accruals?

An example is a payment made in December for property insurance covering the next six months of January through June. The amount that is not yet expired should be reported as a current asset such as Prepaid Insurance or Prepaid Expenses. The amount that expires in an accounting period should be reported as Insurance Expense. Generally accepted accounting principles require businesses to recognize revenue when it’s earned and expenses as they’re incurred. Often, however, the timing of a payment may differ from when it’s received or an expense is made, so accrual and deferral methods are used to adhere to accounting principles.

Thereby becoming a source of revenue for the company that is to be reported in the financial statements. It is the revenue that the company has already received before its services for the money earned was executed.

On January 1st, when the company receives cash payments from the customer, the company will debit cash for $48,000 and credit the deferred revenue account for $48,000. Cash accounting offers the easiest way — you simply recognize the revenue at the time you receive the payment which can work for certain businesses. However, in some situations, cash accounting can lead to problems when the payment you receive does not come at the same time as the goods or services you provide. For example, you may sell a product or service and be waiting for payment, or you may receive payment for a subscription to a service that you provide over time. In both of these cases, it’s not possible to match income and expenses when you use cash accounting.

For instance, 6 months’ rent paid upfront is reported in a deferred expense account and spread out over the six month period. Deferred RevenueDeferred Revenue, also known as Unearned Income, is the advance payment that a Company receives for goods or services that are to be provided in the future. The examples include subscription services & advance premium received by the Insurance Companies for prepaid Insurance policies etc. Using these methods consistently helps someone looking at a balance sheet understand the financial health of an organization during the accounting period. It also helps company owners and managers measure and analyze operations and understand financial obligations and revenues. By using these methods and following GAAP, investors and other stakeholders are also able to better evaluate a company’s financial health and compare performance against competitors.

Similarities Between Accruals And Deferrals

If the goods are received or the service provided AFTER June 30th, the expense should be encumbered. Period expenses are those that belong in the current period and are never accrued or deferred. They are not related to specific operations but instead to the whole operation.

For instance, in a case where a service is offered to a client, but actual revenue is yet to be received, the revenue is transferred to a revenue accrued account. After the payment is received, the revenue previously accrued is deducted based on the revenue received. Deferred expenses refer to those obligations that the company has already paid in a particular accounting period; however, the benefits of these expenses have not been availed in the same accounting period. Deferral ExpensesDeferred expenses refer to those obligations that the company has already paid in a particular accounting period; however, the benefits of these expenses have not been availed in the same accounting period. Accrual of an expense refers to the reporting of that expense and the related liability in the period in which they occur.

This lesson completes the treatment of the accounting cycle for service type businesses. These include the preparation of adjusting entries, preparing the financial statements themselves, drafting the footnotes to the statements, closing the accounts, and preparing for the audit. Both buyers and sellers will likely encounter book-tax differences, which must be analyzed and recorded as well. They can both be used for expenses or revenues based on the nature of the transaction. These adjusting entries ensure that a fair valuation is given to the customer or the business with whom the transaction was conducted. It makes sure that both parties of the agreement have recorded their accounts accordingly so that no discrepancy is left unwarranted. The second type of deferral is called the Revenue Deferral, which refers to money that was received before it was earned.

The reversal of the AVAE will result in a debit to expense, appropriately moving recognition of the expense to the correct fiscal year. Must include the date the service was performed or the goods delivered, customer name, invoice number and an explanation. The normal practice in your self-supporting fund is to invoice a month after the services are rendered. This means consulting services provided in June of one fiscal year are invoiced after that year’s fiscal close and post in July of the next fiscal year. Must include the date the goods/services were received, vendor name, purchase order number or invoice number and an adequate explanation. If an estimate is used, include the calculation method in the explanation.

There will be an invoice paid/posted to next fiscal year’s ledgers for goods/services received in the current fiscal year. • Similarly, you pay out cash to cover for wages of employees but recognize it later in your books. Accrued Revenue, on the other hand, is recognized before cash is received. Thanks again to Lighter Capital for sharing this article with inDinero’s audience! We both encourage all business owners to learn more about cash, accrual, and GAAP as they grow their business and its accounting.

How Do Adjustments Affect Financial Results?

The original copy of this receipt is given to the customer, while the seller keeps the other copy for accounting purposes. Most commonly, expenses that are pre-paid are deferred, including insurance or rent. Other expenses that are deferred include supplies or equipment that are bought now but used over time, deposits, service contracts, or subscription-based services. Deferred revenue is received now but reported in a later accounting period.

Not using accrued revenue in SaaS would lead to revenue recognition at longer intervals, since revenues would only be recognized when invoices are issued. For instance, a service that should be provided for six months may be paid in full in the first month. In this case, the lump sum payment is spread over the fiscal period by recording it a deferred revenue account.

Using the accrual method, you would account for the expense needed in pursuit of revenue. In accounting, a deferral refers to the delay in recognition of an accounting transaction. In the case of the deferral of an expense transaction, you would debit an asset account instead of an expense account.

For instance, long term construction projects are reported on the percentage of completion basis. But under most circumstances, revenue will be recorded and reported after a sale is complete, and the customer has received the goods or services. •The large external cash flow determines when a portfolio is to be revalued for performance calculations. This is differentiated from a significant cash flow, which occurs in situations where cash flows disrupt the implementation of the investment strategy. •Composite returns must be calculated by asset weighting the individual portfolio returns using beginning-of-period values or a method that reflects both beginning-of-period values and external cash flows.