Accounts Receivable Turnover Ratio: Formula and Definition

Current assets listed on an organization’s balance sheet embrace money, accounts receivable, stock and other property that are expected to be liquidated or became money in less than one 12 months. Current liabilities include accounts payable, wages, taxes payable, and the present portion of long-time period debt. If the accounts receivable stability is growing sooner than gross sales are growing, the ratio goes down. The two primary causes of a declining ratio are modifications to the company’s credit score coverage and rising problems with accumulating receivables on time.

How do you find average accounts receivable?

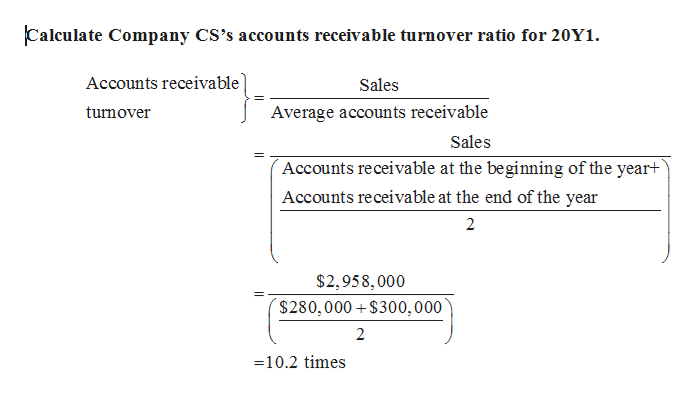

Average accounts receivable is the sum of starting and ending accounts receivable over a time period (such as monthly or quarterly), divided by 2.

Large retailers can even reduce their inventory volume through an environment friendly provide chain, which makes their present assets shrink against current liabilities, resulting in a lower current ratio. To calculate the ratio, analysts compare a company’s present assets to its current liabilities.

Stimulus checks: What shoppers ought to think about doing with the money

Accounts Receivable is the entire amount of cash owed to your business by your customers from gross sales on account. AR is taken into account an asset of your corporation, because it represents an amount of cash you will collect at some future date. However, the AR steadiness tells creditors and buyers very little about your business.

Video Explanation of Different Accounts Receivable Turnover Ratios

The ratio additionally measures how many occasions a company’s receivables are transformed to cash in a interval. The receivables turnover ratio could possibly be calculated on an annual, quarterly, or month-to-month basis. The accounts receivable turnover ratio is an accounting measure used to quantify an organization’s effectiveness in accumulating its receivables or money owed by purchasers. The ratio exhibits how properly an organization uses and manages the credit score it extends to customers and the way rapidly that brief-term debt is collected or is paid. The receivables turnover ratio is also referred to as the accounts receivable turnover ratio.

While the total debt to total belongings ratio includes all money owed, the long-time period debt to assets ratio solely takes into account long-time period money owed. The debt ratio (whole debt to belongings) measure takes into consideration each long-time period debts, similar to mortgages and securities, and present or brief-term debts such as rent, utilities and loans maturing in lower than 12 months. Both ratios, nevertheless, embody all of a business’s property, including tangible property such as equipment and inventory and intangible property such as accounts receivables. Because the whole debt to property ratio includes more of a company’s liabilities, this quantity is almost at all times higher than a company’s lengthy-term debt to assets ratio.

For instance, a ratio of 2 means that the corporate collected its average receivables twice in the course of the yr. In different phrases, this firm is accumulating is cash from clients each six months.

If the credit score policy has changed to permit prospects more time to pay, this could have a major drag on a company’s assets, as a result of it’s money that’s not coming in as quickly. If the problem is that customers are merely not paying on time, administration must evaluation assortment insurance policies to appropriate the issue quickly. Like most other financial statement ratios, A/R turnover is not related as a stand-alone number. It is the course that a company’s turnover goes that tells a narrative as as to whether the company is bettering or declining.

The accounts receivable turnover ratio measures a company’s effectiveness in collecting its receivables or cash owed by purchasers. The ratio exhibits how well an organization makes use of and manages the credit it extends to customers and the way rapidly that short-term debt is transformed to money. Accounts receivable turnover ratio is calculated by dividing your web credit score sales by your average accounts receivable. The ratio is used to measure how efficient a company is at extending credit and collecting debts. Generally, the upper the accounts receivable turnover ratio, the more efficient your business is at amassing credit out of your clients.

Accounts Receivable Turnover in Days

- The debt ratio (whole debt to property) measure takes into account both long-term debts, corresponding to mortgages and securities, and current or quick-term debts similar to hire, utilities and loans maturing in lower than 12 months.

- While the entire debt to complete property ratio consists of all debts, the long-time period debt to assets ratio only takes into account long-term money owed.

It is calculated by dividing the entire credit score sales by the accounts receivable steadiness. Some corporations use the common of the beginning of 12 months A/R and end of yr, while others simply use the top of 12 months stability.

The ratio shows how well a company uses and manages the credit score it extends to prospects and how rapidly that brief-time period debt is collected or being paid. A excessive receivables turnover ratio can point out that an organization’s collection of accounts receivable is efficient and that the corporate has a excessive proportion of quality customers that pay their money owed shortly. A excessive receivables turnover ratio may also point out that a company operates on a money basis. The receivables turnover ratio measures the efficiency with which an organization collects on their receivables or the credit it had prolonged to its customers.

A excessive turnover ratio signifies a mix of a conservative credit score coverage and an aggressive collections department, in addition to a number of high-quality clients. A low turnover ratio represents a possibility to collect excessively outdated accounts receivable that are unnecessarily tying up working capital. Low receivable turnover could also be caused by a unfastened or nonexistent credit policy, an inadequate collections function, and/or a big proportion of shoppers having monetary difficulties. It can be quite likely that a low turnover degree indicates an extreme amount of bad debt. A/R turnover is an efficiency ratio that tells an analyst how quickly the company is amassing, or turning over, its accounts receivable based mostly on the quantity of credit score gross sales it had in the interval.

The accounts turnover ratio is calculated by dividing complete net sales by the typical accounts receivable balance. As a reminder, this ratio helps you take a look at the effectiveness of your credit score, as your internet credit score gross sales value does not embody cash since cash doesn’t create receivables. In different words, if an investor chooses a beginning and ending level for calculating the receivables turnover ratio arbitrarily, the ratio could not reflect the company’s effectiveness of issuing and accumulating credit score. As such, the beginning and ending values selected when calculating the common accounts receivable ought to be fastidiously chosen so to precisely reflect the corporate’s performance. Investors could take a mean of accounts receivable from each month during a 12-month interval to help clean out any seasonal gaps.

Since the receivables turnover ratio measures a enterprise’ ability to efficiently acquire itsreceivables, it only makes sense that a better ratio could be more favorable. Higher ratios imply that corporations are accumulating their receivables extra frequently all year long.

This implies that Primo collects nearly their whole AR balance a minimum of eight occasions per yr and that it’s taking about one-and-a-half months or about forty five days after a sale is made to gather the money. Not only is that this necessary data for collectors, but it additionally helps the enterprise more accurately plan its money flow wants.

What is the Accounts Receivable Turnover Ratio?

To use the knowledge, they’ll want to know accounts receivable turnover, or how typically you are amassing the worth of your accounts receivable. To calculate AR turnover, you have to begin by discovering common accounts receivable. Additionally, some corporations, especially bigger retailers similar to Wal-Mart, have been capable of negotiate for much longer-than-average fee phrases with their suppliers. If a retailer doesn’t supply credit to its clients, this can show on its balance sheet as a excessive payables steadiness relative to its receivables stability.

Company critiques

If the effectivity stays the same, the A/R balance should increase as gross sales improve, and fall as gross sales fall. Changes in the ratio point out that one thing is changing in the way accounts receivable are being handled. Along with other commonplace monetary statement analytic tools, the accounts receivable turnover ratio is a helpful benchmark for a small business to track regularly. The ratio tells a narrative concerning the firm’s sales and receivables cycle and may give administration an early warning of trouble, in time to have the ability to appropriate its insurance policies and procedures with out serious monetary harm.

Accounts receivable turnover is the variety of occasions per yr that a enterprise collects its common accounts receivable. The ratio is used to judge the flexibility of an organization to effectively issue credit to its customers and acquire funds from them in a well timed manner.