Under this methodology, income is not recognized till the money associated with the revenue is obtained by the enterprise. Likewise, bills are not acknowledged till the business pays the related expense. While cash foundation is simpler to use, utilizing it for financial reporting purposes can be misleading as it could possibly distort the results of economic activity.

The expense is recognized on the date of payment, which is August 10. The different is accrual accounting, the place revenue and expenses are recorded when they are incurred.

The two primary methods are accrual accounting and money accounting. Cash accounting stories income and expenses as they are obtained and paid; accrual accounting stories them as they are earned and incurred. Accrual accounting is a method of accounting the place revenues and expenses are recorded when they’re earned, regardless of when the cash is actually received or paid. For example, you’ll report income when a challenge is complete, somewhat than if you get paid.

Because of 1986 regulation, normally, building companies don’t use the money technique of accounting. Some construction businesses use the money methodology; and there are many different corporations that use a modified form of the money methodology, which is appropriate under federal earnings-tax regulations. The cash basis of accounting acknowledges revenues when cash is obtained, and expenses when they are paid.

Accrual accounting includes stating revenues and bills as they happen, not necessarily when cash is obtained or paid out. In distinction, money accounting methods don’t report any revenue or expenses until the cash actually adjustments hands. In general, most companies use accrual accounting, while people and small businesses use the money method. The IRS states that qualifying small business taxpayers can select either method, however they must stick with the chosen methodology.

By matching revenues with expenses, the accrual method is meant to provide a extra correct picture of a company’s true monetary situation. Under the accrual technique transactions are recorded when they’re incurred rather than awaiting fee. This means a purchase order is recorded as revenue despite the fact that fund usually are not acquired instantly. The identical goes for expenses in that they’re recorded despite the fact that no cost has been made. Accounting technique refers back to the rules a company follows in reporting revenues and bills.

For a group of C firms that information a consolidated return, the gross receipts of all the corporations within the group are aggregated for the $5 million check. The tax code allows a enterprise to calculate its taxable revenue using the money or accrual basis, but it can not use both. For financial reporting functions, U.S accounting standards require companies to operate underneath an accrual foundation. Some small companies that aren’t publicly traded and are not required to make many financial disclosures function beneath a cash foundation. The “matching precept” is why companies are required to use one methodology consistently for each tax and monetary reporting purposes.

This normal states that expenses ought to be recognized when the income that creates these liabilities is recognized. Without matching revenues and expenses, the general exercise of a enterprise can be greatly misrepresented from period to interval. As a foundation of accounting, this is in distinction to the alternative accrual technique which records income objects when they are earned and data deductions when expenses are incurred regardless of the move of cash. The value of accrual accounting becomes extra evident for big, advanced businesses.

Limitations of Cash Accounting

What does cash mean in accounting?

cash definition. A current asset account which includes currency, coins, checking accounts, and undeposited checks received from customers. The amounts must be unrestricted. (Restricted cash should be recorded in a different account.)

In common, companies can only deduct bills which might be acknowledged within the tax 12 months. The alternative of income/expense recognition method can decide which 12 months a enterprise can deduct its bills. Likewise, an organization that receives fee from a client in 2018 for companies rendered in 2017 will only be allowed to incorporate the income in its financial statements for 2018.

If the enterprise makes sales on credit score, nevertheless, fee may not be obtained in the identical accounting period. In truth, credit score purchases are one of the many contributing components that make enterprise operations so complex. Establishing the way you want to measure your small business’s expenses and earnings is essential for financial reporting and tax functions. However, your corporation should choose one technique for revenue and expense measurement underneath tax law and underneath U.S. accounting rules. Accrual accounting relies on the matching precept, which is meant to match the timing of revenue and expense recognition.

- Accrual accounting involves stating revenues and expenses as they occur, not necessarily when cash is obtained or paid out.

- In distinction, money accounting methods don’t report any income or bills until the cash really adjustments palms.

- In general, most companies use accrual accounting, while individuals and small businesses use the money method.

What is an example of cash accounting?

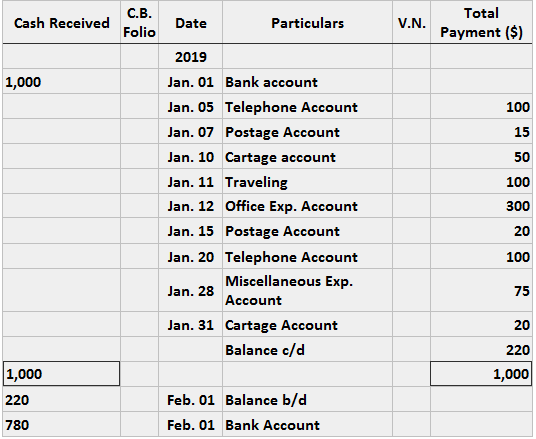

Cash accounting. May 07, 2018. Cash accounting is an accounting methodology under which revenue is recognized when cash is received, and expenses are recognized when cash is paid. For example, a company bills a customer $10,000 for services rendered on October 15, and receives payment on November 15.

If a enterprise generates more than $5 million in annual sales, however, it should use the accrual method, according to Internal Revenue Service guidelines. Generally, a small enterprise can use both the overall cash methodology of accounting or an total accrual method of accounting. Under the cash method (which is typically less complicated than the accrual methodology), a taxpayer can defer revenue till cash is acquired; conversely, it should wait to deduct expenses until the amounts are paid. The overall cash technique of accounting is available for S corporations, partnerships that wouldn’t have a C corporation as a partner, and private service firms (PSCs). C corporations and partnerships with a C company as a associate can use the cash method if their common annual gross receipts for the prior three tax years are less than $5 million.

This technique does not acknowledge accounts receivable or accounts payable. Cash accounting is an accounting methodology beneath which revenue is recognized when money is obtained, and expenses are recognized when cash is paid. For example, an organization bills a customer $10,000 for providers rendered on October 15, and receives payment on November 15. A sale is recorded on the cash receipt date, which is November 15. Similarly, the corporate receives a $500 invoice from a supplier on July 10, and pays the bill on August 10.

What Are the Objectives of Financial Accounting?

A construction firm, for instance, could undertake an extended-term challenge and may not obtain full cash funds until the challenge is complete. Under cash accounting rules, the company would incur many expenses but wouldn’t acknowledge revenue till cash was acquired from the shopper. So the e-book of the company would look weak till the revenue actually got here in. If this company was in search of financing from a financial institution, for instance, the cash accounting methodology makes it look like a poor bet as a result of it is incurring bills but no income.

The distinction between cash and accrual accounting lies in the timing of when gross sales and purchases are recorded in your accounts. Cash accounting recognizes income and bills only when money modifications arms, however accrual accounting recognizes income when it’s earned, and bills once they’re billed (but not paid). There are also tax penalties for companies that undertake the money accounting technique of recognizing cash inflows and outflows.

The chosen method must also accurately replicate enterprise operations. Cash accounting is an accounting methodology that is comparatively simple and is often utilized by small companies.

Accrual accounting relies on the concept of matching revenueswith bills. In enterprise, many instances these occur concurrently, but the cash transaction is not at all times accomplished immediately. Businesses with stock are virtually at all times required to make use of the accrual accounting method and are an excellent instance for instance the way it works. The business incurs the expense of stocking stock and can also have sales for the month to match with the expense.

Cash accounting is an accounting technique during which cost receipts are recorded during the period they’re acquired, and bills are recorded within the period by which they are really paid. In other words, revenues and expenses are recorded when money is obtained and paid, respectively.

Understanding Cash Accounting

In money accounting, transaction are solely recorded when money is spent or received. In cash accounting, a sale is recorded when the cost is acquired and an expense is recorded only when a bill is paid. The cash accounting technique is, after all, the strategy most of us use in managing personal funds and it is appropriate for companies up to a sure dimension.