Accounting Methods

The $2,400 transaction was recorded within the accounting records on December 1, but the quantity represents six months of protection and expense. By December 31, one month of the insurance coverage and price have been used up or expired. Hence the earnings statement for December should report just one month of insurance value of $four hundred ($2,four hundred divided by 6 months) in the account Insurance Expense. The steadiness sheet dated December 31 ought to report the cost of 5 months of the insurance coverage that has not but been used up. Since it’s unlikely that the $2,four hundred transaction on December 1 was recorded this way, an adjusting entry shall be wanted at December 31, 2019 to get the income statement and balance sheet to report this precisely.

Step Two: Journalizing the Transactions

Because these two are getting used on the similar time, it is important to understand the place every goes in the ledger. Keep in mind that the majority business accounting software keeps the chart of accounts flowing the background and you often have a look at the main ledger. Debits increase the stability of dividends, bills, assets and losses.

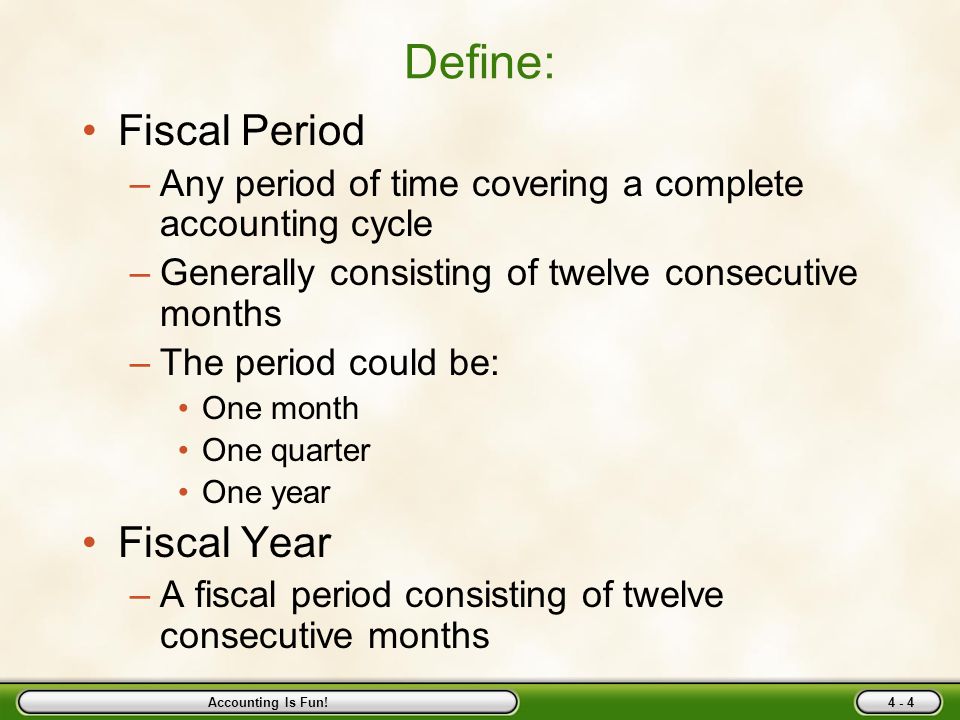

Accounting Cycle Fundamentals

The entries are primarily based on the receipt of an bill, recognition of a sale, or completion of other economic occasions. After the corporate posts journal entries to particular person general ledger accounts, an unadjusted trial stability is prepared. The trial steadiness ensures that total debits equal the entire credits within the monetary information. These are the result of corrections made and the results from the passage of time. For example, an adjusting entry might accrue interest income that has been earned based mostly on the passage of time.

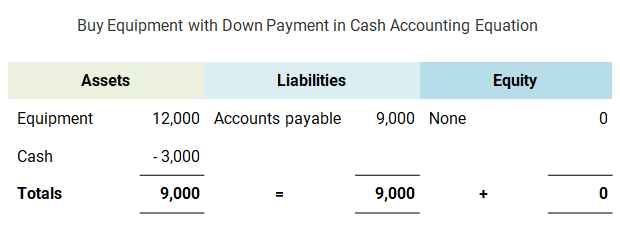

Accounts with a net Debit steadiness are generally proven as Assets, while accounts with a internet Credit steadiness are typically shown as Liabilities. The fairness section and retained earnings account, principally reference your profit or loss. Therefore, that account may be positive or negative (depending on when you made cash). When you add Assets, Liabilities and Equity collectively (utilizing optimistic numbers to characterize Debits and unfavorable numbers to symbolize Credits) the sum must be Zero.

Once all the enterprise accounts have been balanced, they’re closed out for that interval and new ones created for the subsequent accounting interval. Another scenario requiring an adjusting journal entry arises when an quantity has already been recorded in the company’s accounting data, however the amount is for greater than the current accounting period. To illustrate let’s assume that on December 1, 2019 the company paid its insurance coverage agent $2,four hundred for insurance protection through the interval of December 1, 2019 via May 31, 2020.

For accounts with a debit stability, debit entries improve the steadiness and credit score entries decrease it. It is the place double entry bookkeeping entries are recorded by debiting a number of accounts and crediting one other one or more accounts with the same complete quantity. DetailDebitCreditCash$11,670-Accounts receivable-zero–Prepaid insurance2,420-Supplies3,620-Furniture16,020-Accounts payable-220Unearned consulting revenue-3,000Notes payable-6,000Mr. If the sum of the debit entries in a trial balance doesn’t equal the sum of the credits, meaning there’s been an error in both the recording or posting of journal entries.

A journal can be named the guide of authentic entry, from when transactions have been written in a journal previous to manually posting them to the accounts in the general ledger or subsidiary ledger. Manual methods often had a wide range of journals such as a sales journal, purchases journal, money receipts journal, cash disbursements journal, and a basic journal. Depending on the business’s accounting data system, specialized journals could also be used in conjunction with the general journal for document-preserving.

If the sum of the debit aspect is greater than the sum of the credit score facet, then the account has a “debit balance”. If the sum of the credit side is larger, then the account has a “credit stability”.

Credits improve the stability of gains, income, revenues, liabilities, and shareholder fairness. An organization begins its accounting cycle with the recording of transactions using journal entries.

- Keep in thoughts that most business accounting software keeps the chart of accounts flowing the background and also you usually have a look at the main ledger.

- Because these two are being used on the similar time, it is very important understand the place every goes in the ledger.

The common ledger serves as the eyes and ears of bookkeepers and accountants and reveals all financial transactions inside a business. Essentially, it is a big compilation of all transactions recorded on a specific document or on accounting software program, which is the predominant method nowadays. For instance, if you want to see the modifications in cash levels over the course of the business and all their related transactions, you would look at the overall ledger, which exhibits all the debits and credits of money. Figures beneath “Debits” and “Credits” have been posted to the T-account from the journal (see Exhibit 3, beneath, for pattern journal transactions). Because Cash on Hand is an Asset account, it carries a so-known as Debit stability.

The easiest handiest way to understand Debits and Credits is by really recording them as constructive and adverse numbers directly on the balance sheet. If you receive $one hundred cash, put $100 (debit/Positive) subsequent to the Cash account. If you spend $a hundred cash, put -$one hundred (credit/Negative) next to the money account. The next step can be to balance that transaction with the alternative sign in order that your balance sheet adds to zero. The means of doing these placements are simply a matter of understanding the place the money came from and the place it goes within the particular account sorts (like Liability and net property account).

What is the accounting cycle?

The accounting cycle is the holistic process of recording and processing all financial transactions of a company, from when the transaction occurs, to its representation on the financial statements. The cycle repeats itself every fiscal year as long as a company remains in business.

You should create an account to continue watching

So if $a hundred Cash came in and you Debited/Positive subsequent to the Cash Account, then the following step is to find out the place the -$one hundred is classed. If you got it as a mortgage then the -$a hundred could be recorded subsequent to the Loan Account. If you received the $one hundred since you sold something then the $-one hundred can be recorded subsequent to the Retained Earnings Account. If everything is viewed by way of the steadiness sheet, at a really high degree, then selecting the accounts to make your balance sheet add to zero is the image.

The full accounting equation primarily based on trendy approach may be very easy to remember if you give attention to Assets, Expenses, Costs, Dividends (highlighted in chart). Conversely, a decrease to any of these accounts is a credit or right facet entry. On the opposite hand, increases in revenue, liability or fairness accounts are credits or proper aspect entries, and reduces are left facet entries or debits. Upon the posting of adjusting entries, a company prepares an adjusted trial stability followed by the monetary statements.

Accounting Cycle

An entity closes short-term accounts, revenues, and expenses, on the end of the period using closing entries. Finally, a company prepares the submit-closing trial balance to make sure debits and credits match. After all the transactions have been posted to the final ledger within the appropriate accounts, Cynthia will put together an unadjusted trial stability. Cynthia needs to ensure that the debits and credit in the general ledger are balanced.

For every debit entry, there must be a credit entry that retains the books in stability. Based on the transactions recorded as part of the accounting cycle, financial statements similar to money move reviews, revenue and loss statements, and stability sheets could be prepared.

In such case, use of the overall journal could also be limited to non-routine and adjusting entries. At the tip of any monetary period (say at the end of the quarter or the yr), the net debit or credit quantity is referred to as the accounts steadiness.