Start by opening up a business checking account, followed by any savings accounts that will help you organize funds and plan for taxes. For instance, set up a savings account and squirrel away a percentage of each payment as your self-employed tax withholding. A good rule of thumb is to put 25% of your income aside, though more conservative estimates for high earners might be closer to one third.

This is the process that businesses use to ensure it gets a positive review. Since Enron and the accounting scandals of the early 2000s, this practice has been prohibited. Once the company prepares its financial statements, it will contract an outside third party to audit it. It is the audit that assures outside investors and interested parties that the content of the statements are correct.

Free, Online Financial Accounting Basics Course

There are many more formulas that you can use, but the eight that we provided are some of the most important. Retained earnings represent the sum of all net income since business inception minus all cash dividends paid since inception. The cost of goods sold equation allows you to determine how much you spent on manufacturing the goods you sold. By subtracting the costs of goods sold from revenues, you’ll determine your gross profit. Cost of purchasing new inventory is the amount of money your company has to spend to secure the necessary products or materials to manufacture your products.

However, at the end of the year the company discovers it only used 50 units. The company must then make an adjusting entry to reflect that, and decrease the amount of the expense and increase the amount of inventory accordingly.

Fundamental Accounting Equation

Check out the following accounting software you could use to manage your books. You want your accounting software to easily integrate with your ecommerce platform, as well as third-party tools like contract management and more. But before you sign off on the debt, it’s important to make sure the numbers make sense.

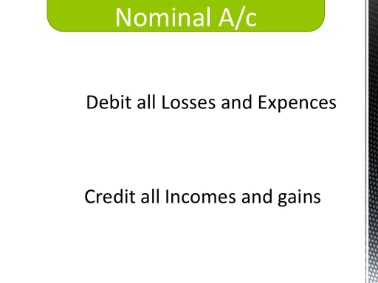

What is the rule of nominal account?

The golden rule for nominal accounts is: debit all expenses and losses and credit all income and gains.

Accruals are credits and debts that you’ve recorded but not yet fulfilled. These could be sales you’ve completed but not yet collected payment on or expenses you’ve made but not yet paid for. A cash flow statement analyzes your business’s operating, financing, and investing activities to show how and where you’re receiving and spending money. Accounting is the process of systematically recording, analyzing, and interpreting your business’s financial information.

Accounts That Make Up A Trial Balance

Credits and debits make up the two types of entries, with credits entered on the left side and debits entered on the right. A much more simplified system, single-entry bookkeeping records only one entry per transaction. Capital refers to a person’s or organization’s financial assets. Capital may include funds in deposit accounts or money from financing sources. Working capital refers to a business’s liquid capital, which the owner can use to pay for day-to-day or ongoing expenses. A company’s working capital indicates its overall health and ability to meet financial obligations due within a year. Most traditional businesses and nonprofits alike have a small amount of cash on hand for small, miscellaneous expenses (i.e. stamps, a taxi, small office supplies).

Good accounting also allows for grant applications to be more accurate in requesting funding for projects. Without good accounting, an organization has little hope of effectively expanding and maintaining that expansion.

How Much Does It Cost To Start A Business? Shopify Research

Find an accounting software that makes it easy to account for sales tax. Although the IRS allows all businesses to use the accrual method of accounting, most small businesses can instead use the cash method for tax purposes. The cash method can offer more flexibility in tax planning because you can sometimes time your receipt of revenue or payments of expenses to shift these items from one tax year to another. Most individuals use the cash method for their personal finances because it’s simpler and less time-consuming.

In that case, the company might need to start considering the liquidation value of assets. Accrual basis financial statements match income and expenses to the periods in which they are incurred.

You can review the video lessons as many times as you like and complete the courses at a pace that is most convenient for you. All of the required courses, resources, and assessments to obtain the certifications will be provided, for as long as your subscription is active. The Accounting fundamentals course is a course every aspiring accounting and finance student should take. The best understanding I obtained through this online course. This was great and very engaging, concepts explained very nicely and was easy to follow. It was annoying that I had to keep clicking “Next” every seconds because this was how long the average video was.

The resulting information is an essential feedback loop for management, so that they can see how well a business is performing against expectations. The following discussion of accounting basics is needed to give you a firm grounding from which to understand how an accounting system works and how it is used to generate financial reports. A journal entry refers to a business transaction recorded in a business’s general ledger. A journal entry may include the journal entry date and number, account name and number, debit, and credit.

Liabilities are obligations that it must pay, including things like lease payments, merchant account fees, accounts payable, and any other debt service. The accounting equation displays that all assets are either financed by borrowing money or paying with the money of the company’s shareholders. To ensure that a company is “in balance,” its assets must always equal its liabilities plus its owners’ equity. It’s ours; therefore, from the bank’s perspective the deposit is viewed as a liability . When we deposit money into our accounts, the bank’s liability increases, which is why the bank credits our account.

Determining payroll includes keeping track of hours worked, distributing payments, and separating out money for Social Security and Medicare taxes. Inventory refers to a company’s goods and raw materials used for making the goods it sells. Inventory includes finished goods, raw materials, and works-in-progress.

If you were making a profit and loss statement for the first quarter of 2019, for example, you wouldn’t cover transactions that occurred accounting basics before or after the quarter. This ensures that the company can accurately compare performance in different time periods.

Become A Certified Financial Modeling & Valuation Analyst Fmva®

Get clear, concise answers to common business and software questions. Product Reviews Unbiased, expert reviews on the best software and banking products for your business. Beginner’s Guides Our comprehensive guides serve as an introduction to basic concepts that you can incorporate into your larger business strategy. This part of accounting — tax obligation and collection — is particularly tedious.

COGS. These are the direct costs incurred in producing products sold by a company. Selling to international customers can be easier than domestic sales. Canadian store owners don’t need to charge GST/HST to customers who are outside of Canada. Business planning is often used to secure funding, but plenty of business owners find writing a plan valuable, even if they never work with an investor. That’s why we put together a free business plan template to help you get started.

- While we’d love for you to try our award-winning payroll products, they are not required to use our accounting software.

- All financial information, both negative and positive, is disclosed accurately.

- Variable expenses do change monthly, and they may include discretionary or unpredictable but necessary costs.

- The system uses one entry per transaction to record cash, taxable income, and tax-deductible expenses going in or out of the business.

- The accounting process includes summarizing, analyzing, and reporting these transactions to oversight agencies, regulators, and tax collection entities.

- Applicant Tracking Zoho Recruit Zoho Recruit combines a robust feature set with an intuitive user interface and affordable pricing to speed up and simplify the recruitment process.

- Basic accounting is one of the key functions in almost all types of business.

Adjusting entries allow the company to go back and adjust those balances to reflect the actual financial activity during the accounting period. The process of preparing the financial statements begins with the adjusted trial balance. Preparing the adjusted trial balance requires “closing” the book and making the necessary adjusting entries to align the financial records with the true financial activity of the business. The term accrual is also often used as an abbreviation for the terms accrued expense and accrued revenue. The balance sheet summarizes your company’s assets, liabilities, and equity at a specific point in time. Get a breakdown of what you owe and what’s owed to you with this accounting software report.

Of course, a software isn’t an end-all-be-all solution and is only as good as the information that you put into it. If you are truly new to nonprofit accounting, we highly recommend that you have a dedicated treasurer put into place to be in charge of choosing, updating, and maintaining your software. Payroll can be a complex subject, especially for nonprofits where every cent counts. While this can be done in-house, we highly suggest to have a verified accountant that practices in your state review your payroll processing. Once something has been recorded as a fixed asset , its life duration needs to be determined so that depreciation can be calculated and recorded.

The Accounting Cycle

In this course you will learn about the importance of accuracy in financial statements, and how they provides crucial information for key business decisions. Start this free online course to learn how to complete accurate, relevant, and reliable financial statements. We recommend the accrual method for all businesses, even if the IRS permits the cash method, because accrual gives you a clearer picture of the financial status of your business.