05.05.2020 by Quentin DconWho is the Primary Borrower for a Joint Mortgage?You would receive $9,759 and make 36 scheduled monthly payments of $301.10. A 5-12 months $10,000 loan with a Prosper Rating of A would have an interest rate of eight.39% and a 5.00% origination fee wi... Read more

05.05.2020 by Quentin DconWhat is the opposite of lend?OTHER WORDS FROM borrowYou pay it again plus interest and a money advance charge, which is both a set charge or proportion of the quantity you borrow. If you can answer no to all three of the questions above, you are more... Read more

04.05.2020 by Quentin DconWhere To Sell Used Books: 6 Of The Best Places OnlineIncreased debt will make a optimistic contribution to a firm's ROE only if the matching return on property (ROA) of that debt exceeds the rate of interest on the debt. Investors may discover the P/... Read more

04.05.2020 by Quentin DconIf a company’s BVPS is larger than its market worth per share—its present inventory price—then the stock is considered undervalued. If the firm's BVPS increases, the inventory should be perceived as extra priceless, and the inventory price should enh... Read more

04.05.2020 by Quentin DconledgerThere is not any upper limit to the variety of accounts concerned in a transaction - however the minimum is no less than two accounts. Thus, using debits and credits in a two-column transaction recording format is essentially the most essential... Read more

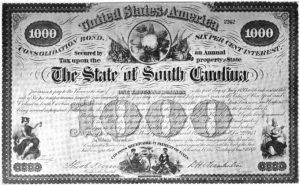

04.05.2020 by Quentin DconWhat are Unsecured Bonds?What is the difference between a bond and a note payable?Bonds payable that mature (or come due) within one year of the balance sheet date will be reported as a current liability if the issuer of the bonds must use a current... Read more

30.04.2020 by Quentin DconUnamortized Bond Discount DefinitionA lower interest rate means the corporate pays much less money in interest expense, which results in an increased web earnings and money flow. The company might have opted to not set up a sinking fund, however it w... Read more

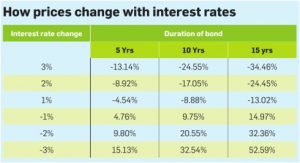

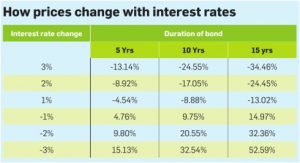

30.04.2020 by Quentin DconWhat’s the Difference Between Premium Bonds and Discount Bonds?Also, as charges rise, traders demand a better yield from the bonds they think about buying. If they anticipate charges to proceed to rise in the future they don't desire a fixed-ra... Read more

30.04.2020 by Quentin DconBond DefinitionThe enterprise will then must report a “bond premium” for the difference between the amount of cash the enterprise received and the bonds’ face value. An group may incur numerous costs when it issues debt to traders.... Read more

30.04.2020 by Quentin DconThe Benefits to Investing in BondsA key threat of proudly owning mounted price bonds is interest rate threat or the chance that bond rates of interest will rise, making an investor’s current bonds less priceless. For example, let’s assume... Read more