10.11.2021 by Quentin DconAny purchases made or items consumed by your business subject to Use Tax. The sale of goods and services within a municipality authorized to levy a Special District Excise Tax for the benefit of economic opportunity development are subject to Special... Read more

09.11.2021 by Quentin DconWith the information laid out in an amortization table, it’s easy to evaluate different loan options. You can compare lenders, choose between a 15- or 30-year loan, or decide whether to refinance an existing loan.The cost of business assets can... Read more

09.11.2021 by Quentin DconOn the bank statement, debit memos commonly are listed first next to each transaction, then the credit memo and finally the running balance. If you want to take ownership over your financial situation, start by learning everything you can about your... Read more

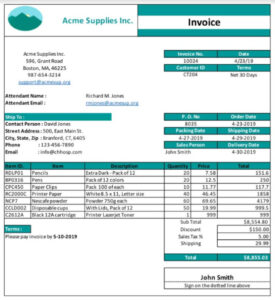

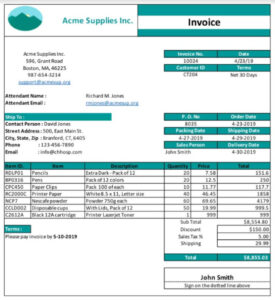

03.11.2021 by Quentin DconDebit memos can be used to correct undercharging on an invoice or to levy ad hoc charges outside the context of a subscription. Just like an invoice, debit memo balances can be settled by applying either a payment or a credit memo. Within a firm, a d... Read more

03.11.2021 by Quentin DconAssets on a balance sheet are classified into current assets and non-current assets. The Balance Sheet is used for financial reporting and analysis as part of the suite of financial statements.The balance sheet details what a business owns , what it... Read more

02.11.2021 by Quentin DconThe full-time salary of an accountant depends upon where you live, but did you know that their average wage, according to Payscale as of 2019, is $50,757? After you pay your employer taxes, you’re going to be closer to $56,000 a year, and that&... Read more

01.11.2021 by Quentin DconNotation Pad is our runner-up as you can easily write and share your original song creations, complete with lyrics and chords. FourChords is also great as it listens to you play and gives you feedback on how to improve, so you can quickly master your... Read more

01.11.2021 by Quentin DconDepending on filing requirements, you’ll need to pay the government all the taxes withheld during a given period of time (e.g., every three months, every 12 months). So if the employee in the example above worked 45 weeksduring the year and had... Read more

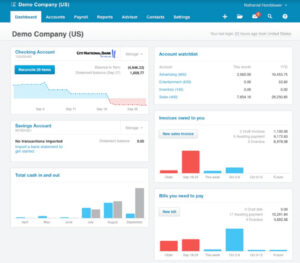

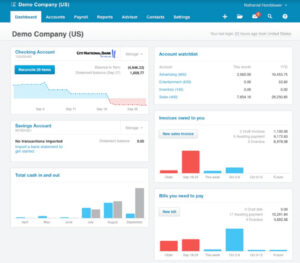

29.10.2021 by Quentin DconIt has an attractive, intuitive interface and dashboard that shows several graphs to give you an overview of your sales over time, income, expenses, and profit and loss. You can click on the images to drill down into each set of information.Finally,... Read more

29.10.2021 by Quentin DconA business records the cost of intangible assets in the assets section of the balance sheet only when it purchases it from another party and the assets has a finite life. Let's say a company spends $50,000 to obtain a license, and the license in ques... Read more