26.11.2021 by Quentin DconThe main objective of bookkeeping is to keep all financial transactions recorded properly and systematically. Accounting’s objective is to gauge a company’s financial situation and to communicate that information with the relevant people.... Read more

25.11.2021 by Quentin DconWe’ll do one month of your bookkeeping and prepare a set of financial statements for you to keep. Financial Intelligence takes you through all the financial statements and financial jargon giving you the confidence to understand what it all mea... Read more

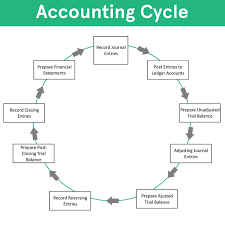

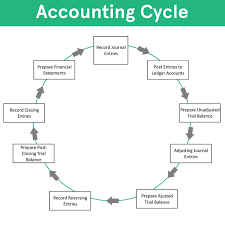

24.11.2021 by Quentin DconSales ledger, which deals mostly with the accounts receivable account. This ledger consists of the records of the financial transactions made by customers to the business. A bookkeeper is responsible for identifying the accounts in which transactions... Read more

23.11.2021 by Quentin DconIncome statements include revenue, costs of goods sold, andoperating expenses, along with the resulting net income or loss for that period. The foundation of the balance sheet lies in the accounting equation where assets, on one side, equal equity pl... Read more

23.11.2021 by Quentin DconNext companies must account for interest income and interest expense. Interest income is the money companies make from keeping their cash in interest-bearing savings accounts, money market funds and the like. On the other hand, interest expense is th... Read more

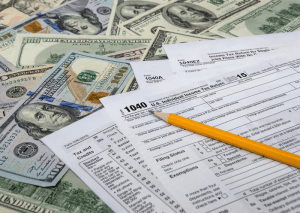

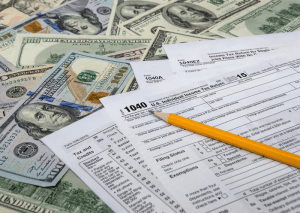

22.11.2021 by Quentin DconThe companies can very well take tax reductions on depreciating items. Businesses calculate it meticulously as they remain the prime part of the industry functionality too. The value reduction of a particular asset is categorized into two types; Depr... Read more

22.11.2021 by Quentin DconUnderstand these critical pieces of notation by exploring the definitions and purposes of debits and credits and how they help form the basics of double-entry accounting. Accounting is a rule-based system that requires memorization of the debits and... Read more

22.11.2021 by Quentin DconThe IRS allows businesses to take several accelerated depreciation deductions for tangible business assets and some improvements. These special options aren't available for the amortization of intangibles. Negative amortization is actually a feature... Read more

19.11.2021 by Quentin DconAn investor who buys a stock on 50% margin will lose 40% if the stock declines 20%.; also in this case the involved subject might be unable to refund the incurred significant total loss. In this ratio, operating leases are capitalized and equity incl... Read more

18.11.2021 by Quentin DconDeferrals, on the other hand, are often related to an expense that is paid in one period but is not recorded until a different period. Both accrual and deferral entries are very important for a company to give a true financial position. Moreover, bot... Read more