For example, interest expense is part of other revenues and expenses, as are most gains or losses on early retirement of debt. An example of off-balance-sheet financing is an unconsolidated subsidiary. A parent company may not be required to consolidate a subsidiary into its financial statements for reporting purposes; however the parent company may be obligated to pay the unconsolidated subsidiaries liabilities. If a company’s Times Interest Earned Ratio falls below 1, the company will have to fund its required interest payments with cash on hand or borrow more funds to cover the payments.

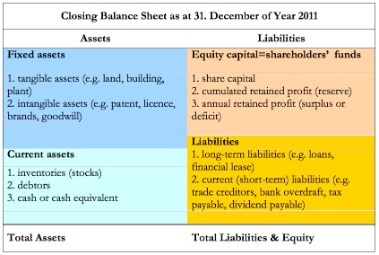

Short term liabilities cover any debt that must be paid within the coming year. Long term liabilities cover any debts with a lifespan longer than one year. Article 35 A lessor shall, in its balance sheet, present the differences between the finance lease receivables less the unrealized finance income as long-term liabilities. All businesses have liabilities, except those who operate solely operate with cash. By operating with cash, you’d need to both pay with and accept it—either with physical cash or through your business checking account. Contingent liabilities – or potential risk – only affect the company depending on the outcome of a specific future event. For example, if a company is facing a lawsuit, they face a liability if the lawsuit is successful but not if the lawsuit fails.

Run A Finance Blog?

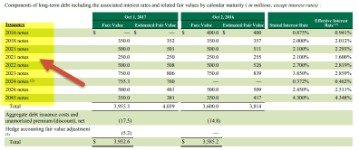

Long‐term liabilities are existing obligations or debts due after one year or operating cycle, whichever is longer. They appear on the balance sheet after total current liabilities and before owners’ equity.

What are 3 types of assets?

Common types of assets include current, non-current, physical, intangible, operating, and non-operating. Correctly identifying and classifying the types of assets is critical to the survival of a company, specifically its solvency and associated risks.

So long as the expected time to receive these revenues is more than one year, these items belong in the deferred revenues account. This may include monies owed to your business from other corporations or even a delay in the processing of existing funds. Funds due to you that have yet to be paid will be accounted for in this section. These expenses are accumulated by providing pension plans to employees, or by matching employee pensions as a form of payment. A necessary liability, this section of your balance sheet will include a large portion of the expenses you pay to employees in full. Deferred long-term liability charges are future liabilities, such as deferred tax liabilities, that are shown as a line item on the balance sheet.

Other long-term liabilities are lumped together on the balance sheet rather than broken down one by one and given an individual figure. Charlene Rhinehart is an expert in accounting, banking, investing, real estate, and personal finance. She is a CPA, CFE, Chair of the Illinois CPA Society Individual Tax Committee, and was recognized as one of Practice Ignition’s Top 50 women in accounting. Daniel Liberto is a journalist with over 10 years of experience working with publications such as the Financial Times, The Independent, and Investors Chronicle. He received his masters in journalism from the London College of Communication. Daniel is an expert in corporate finance and equity investing as well as podcast and video production. Obligations of the business that must be met over a period exceeding one year.

Calculating The Debt

For more advanced analysis, financial analysts can calculate a company’s debt to equity ratio using market values if both the debt and equity are publicly traded. In order to obtain assets used in operations, a company will raise capital through either issuing shareholder’s equity (e.g., publicly traded common stock) or debt (e.g., notes payable). Stakeholders, which include investors and lending institutions, provide companies with capital with an expectation that those companies generate net income through their respective operations. Ford Motor Co. reported approximately $28.4 billion of other long-term liabilities on its balance sheet for fiscal year 2020, representing around 10% of total liabilities. Lumping together a group of debts without identifying the nature of the debt might sound like a potential red flag. In reality, this practice is normal and shouldn’t raise concern, provided that the obligations in question are relatively small compared to the company’s total liabilities. They should also be comparable to how the company has operated in the past—sometimes, year-to-year comparisons of other long-term liabilities are provided in financial statement footnotes.

There are several types of ratios used to measure organizational performance from various angles. The ratio of fixed assets to long-term liabilities is calculated to obtain insight into the solvency of an organization.

Liabilities are one of three accounting categories recorded on a balance sheet—a financial report a company generates from its accounting software that gives a snapshot of its financial health. A freelance social media marketer is required by her state to collect sales tax on each invoice she sends to her clients. It’s still a liability because that money needs to be sent to the state at the end of the month.

What Are The Main Types Of Liabilities?

EBITDA can be calculated by adding back Depreciation and Amortization expenses to EBIT. Interest payments on debt are tax deductible, while dividends on equity are not. Returns to purchasers of debt are limited to agreed- upon terms (i.e., interest rates), however, they have greater legal protection in the event of a bankruptcy.

This article and related content is provided as a general guidance for informational purposes only. Accordingly, Sage does not provide advice per the information included. This article and related content is not a substitute for the guidance of a lawyer , tax, or compliance professional. When in doubt, please consult your lawyer tax, or compliance professional for counsel. This article and related content is provided on an” as is” basis. Sage makes no representations or warranties of any kind, express or implied, about the completeness or accuracy of this article and related content. Accrued vacation should be accounted for as a liability within your profit and loss ledger.

What Are Some Examples Of Current Liabilities?

Current liabilities are debts and interest amounts owed and payable within the next 12 months. Any principal balances due beyond 12 months are recorded as long-term liabilities. Together, current and long-term liability makes up the “total liabilities” section. Current accounts usually include credit accounts your business maintains for inventory and supplies. The long-term debt is most often tied to major purchases used over time to operate the business. The long-term portion of a bond payable is reported as a long-term liability. Because a bond typically covers many years, the majority of a bond payable is long term.

If the result of the calculation is low, it suggests that the company may face a difficult situation in settling its long-term debts using the fixed assets. There are standard ratio levels specified for various types of industries such as manufacturing businesses, real estate, services, etc. The more detailed technical accounting answer will point out that the short-term liability and the long-term liability should change after every month .

Non-current liabilities, on the other hand, don’t have to be paid off immediately. Non-current liabilities, also known as long-term liabilities, are debts or obligations due in over a year’s time. Long-term liabilities are an important part of a company’s long-term financing. Companies take on long-term debt to acquire immediate capital to fund the purchase of capital assets or invest in new capital projects. A long-term liability is an obligation resulting from a previous event that is not due within one year of the date of the balance sheet (or not due within the company’s operating cycle if it is longer than one year).

A long-term liability, on the other hand, is money owed with a due date that’s longer than one year. When the terms of a loan — or any other legally binding financial obligation — give you more than one year to repay it, it’s considered a long-term liability.

Having the right accounting tools at your disposal can help you stay on top of your liability commitments. You won’t need to spend time performing administrative tasks like reconciling your bank statements; match every transaction and commitment automatically so you can spend more time growing your business. A liability is a debt or something owed to other people or organizations. You can turn this around and say that a liability is a claim against your business from these other people or organizations. Apart from that, there could be other short-term obligations that are to be payable within one year. The short-term debts help in meeting the working capital requirements of the firm.

- Ideally, a fixed asset is not consumed and converted into money within twelve calendar months.

- A long-term liability is an obligation resulting from a previous event that is not due within one year of the date of the balance sheet (or not due within the company’s operating cycle if it is longer than one year).

- This article was brought to you byIntrepid Private Capital Group– A Global Financial Services Company.

- Long-term liabilities include any accounts on which you owe money beyond the next 12 months.

- All businesses have liabilities, except those who operate solely operate with cash.

- After fulfilling the obligation, the company records a debit entry in the liabilities account and credit entry in the revenues account.

- Typically, companies use long-term loans to purchase major assets for long-term use.

Current obligations are much more risky than non-current debts because they will need to be paid sooner. The business must have enough cash flows to pay for these current debts as they become due.

Types Of Liabilities: Current Liabilities

Long-term debt shows up in the long-term liabilities section of the balance sheet. A customer deposit refers to the cash a customer deposits with the company before receiving the final goods and services.

What are current and long-term liabilities?

Current liabilities are debts payable within one year, while long-term liabilities are debts payable over a longer period. For example, if a business takes out a mortgage payable over a 15-year period, that is a long-term liability.

The returns an equity holder can achieve have unlimited upside, however, they are typically the last to be paid in the event of a bankruptcy. The Debt-to-Equity Ratio is a financial ratio indicating the relative proportion of shareholder ‘s equity and debt used to finance a company’s assets, and is calculated as total debt / total equity. Benchmarking a company’s credit rating and debt ratios will assist an analyst in determining a company’s financial strength relative to its peers. These costs go to former employees who are retirees of your business and are still receiving health benefits following retirement.

See Advice Specific To Your Business

The present value of a lease payment that extends past one year is a long-term liability. Deferred tax liabilities typically extend to future tax years, in which case they are considered a long-term liability. Mortgages, car payments, or other loans for machinery, equipment, or land are long term, except for the payments to be made in the coming 12 months. The portion due within one year is classified on the balance sheet as a current portion of long-term debt. In business accounting, a liability is any legally binding obligation to pay money or assets to another party. If your business owes money to a vendor or lender, the money owed is considered a liability and, thus, should be recorded on your business’s sheet. Liabilities are resolved, however, by meeting the obligations of the loan, which typically involves paying it back.

Ways Companies Cook The Books

These are loans that will take more than 12 months to repay, known for their large principal amount and often their likelihood to accumulate interest to be paid over a period of time. In financial statements, companies use the term “other” to refer to anything extra that is not significant enough to identify separately. Because they aren’t long term liabilities examples deemed particularly noteworthy, such items are grouped together rather than broken down one by one and ascribed an individual figure. Because a liability is always something owed, it is always considered payable to some entity. Liabilities in accounting are generally expressed as a “payable” alongside various qualifying terms.